Make All These Hater Fall Back Like September Again

As we finally come up out of the pandemic, the housing marketplace has turned hot. Demand is extremely strong from get-go-time homebuyers, merchandise-up buyers, and institutional investors. Merely there'south a hazard the housing marketplace is too hot. Therefore, it'southward worth worrying about the housing market once more.

If you lot program to buy a house, y'all should also call back about what could go incorrect. This way, you won't go blindsided in case things practise. Think nearly all the people who bought real estate in 2007 and early 2008. Things were going wonderful, then the global financial crunch striking! If they had to sell before 2012, they probable lost money.

With the South&P 500 and NASDAQ selling off at the offset of 2022, real estate investors should take notation. The housing market place frenzy should fade every bit interest rates rise. The Federal Reserve could besides tighten too much, too often, and crusade a recession. We already had a -one.iv% 1Q2022 Gdp print.

For the record, I am nonetheless bullish on the housing market place over the next several years. The millennial generation is in full buying mode. Inventory and mortgage rates will remain low. Meanwhile, foreigners are probable going to flood the U.S. real estate market over again subsequently two years of being shut out.

But like any expert investor, it's skilful to encounter the other side of the story.

A Slowdown In Housing Is Inevitable

The pace of business firm price growth will slow considering it cannot outpace income growth by such a wide margin for also long. Bond-tapering and Fed charge per unit hikes started on March 16, 2022. Meanwhile, house prices are high. Affordability is condign an issue.

This pace of double-digit cost appreciation in the housing market is unsustainable. Instead, I think home prices will ascension by closer to eight% in 2022, not 16% like it did in 2021.

Let's go over some more details on why the housing market has some signs of concerns. With such concerns, you may want to invest in a publicly-traded REIT or a private eREIT from Fundrise, instead of buying a single asset with a big mortgage. Diversification is primal in this hot market place.

Why Nosotros Should Start Worrying Most The Housing Market

Taking on massive debt to buy real manor at record highs is risky. Y'all need to be sure y'all're following my 30/30/three home buying rule before proceeding. If you follow my rule, you will significantly increment your chances of being able to comfy beget your dwelling house.

Let's say you lose 50% on your stock and bond portfolio. You'll be upset, but be fine. If your property loses 20% of its value, all the same, this means yous've lost 100% of your 20% downpayment.

Below is the latest U.S. firm growth nautical chart from January 1976 to June 2021. According to the Freddie Mac Firm Cost Alphabetize, business firm cost growth is at an best loftier. Noice the previous all-time high house price growth in the belatedly 1970s and in 2006.

If you are buying belongings today, you need to be prepared for a potential rapid deceleration in prices. Therefore, y'all must buy property strategically if you do purchase.

In this scenario, you'll also probably however be fine – if you don't take to sell. Just when property prices correct by twenty% or more, many people become forced sellers because they've also lost their jobs.

I understand that millennials are coming of buying age and inventory is on the decline, making competition for ownership a habitation violent. Withal, only if yous are fully cognizant of the following points I've highlighted below should you proceed with a belongings purchase today.

Things To Know Before Buying Property Today

Before you lot buy one of the biggest assets in your life, it's good to know the current marketplace condition. Information technology'south besides good to know what could go wrong in the housing market.

1) Rents softened, but are recovering

Given property prices are a role of rental income multiples, a real estate buyer should be looking to buy at like pricing discounts from peak rental periods.

Rents softened in major cities such as New York Urban center, San Francisco, Seattle, and DC due to the pandemic. Even so, I anticipate rents to rebound once nosotros achieve herd amnesty. Only they may not equally people scatter to lower toll areas of the country.

Pay very conscientious attention to the latest monthly rental figures before ownership property. Home prices accept increased while rents softened in 2020. Therefore, the valuation for home is much higher. Rents need to aggressively rebound by ten% or more in 2022 and beyond in many major cities for valuations to render to normal.

2) Mortgage manufacture is still very tight

Here's what'due south going on in the mortgage industry, which is equally stringent equally it has ever been. Only people with 720+ credit scores and 20% downpayment have been able to get a mortgage. This is expert in that a fallout is less likely in the future. But allow's talk almost some concerns.

Liquidity (Profitability) Concerns: A growing pct of people are not paying their mortgages and banks are uncertain if and when payments will resume. Every bit a result, his banking company is only lending to the almost financially fit customers.

Stricter Lending Standards: Due to liquidity (profitability) concerns, banks take significantly tightened lending standards. Here are some of the increased lending standards he mentioned to me dorsum in 2020:

- Temporarily stopped allowing for cash-out refinances

- No longer fully counting RSU values when computing how much a person tin borrow

- Schedule East income (rental income) when calculating how much a person tin borrow is no longer included

- No longer approving Home Equity Lines Of Credit (HELOC)

- Minimum downpayment is 20%

- Raised minimum credit score to qualify for a mortgage to 680

In other words, lending standards are as strict as it gets. Every bit a result, perhaps there is upside to real estate liquidity if at that place is a reversion to pre-pandemic level standards sooner. Just if lending standards continue to tighten, it may squeeze out the marginal heir-apparent in the curt-term.

3) Mortgage rates are finally creeping higher

Mortgage rates hit tape lows in 2020. At present, mortgage rates are on the ascent equally bonds sell off and expectations for inflation is high.

My final mortgage refinance was in 4Q2019 when I locked in a seven/one ARM colossal ARM at 2.626%. I was pumped! However, today, that same rate might exist at 2.875%. The boilerplate thirty-twelvemonth fixed-rate mortgage is closer to 3% today.

The trouble with record-low mortgage rates is that thousands of Americans are tempted to buy likewise much business firm. Americans are violating my xxx/xxx/three home buying rule, which puts the hereafter housing market in jeopardy.

Notice how mortgage rates have soared in 2022. The average 30-year fixed rate mortgage is back to almost five%. Still depression past historical standards, simply more than 1% higher than mortgage rates were in 2021.

Higher mortgage rates in 2022 is the biggest reason to worry about the housing market once again. Higher mortgage rates Volition slow down the housing market, which is why you shouldn't get into crazy bidding wars. That said, I all the same call back prices will increment in 2022 due to undersupply.

iv) Prices accept surpassed their previous peaks in many cities

While every city is different, if you look at the prices in Denver and Dallas, yous'll find that the prices are roughly 45% college than they were in 2006-2007. This price performance is similar to San Francisco'southward. Meanwhile, hot cities like Seattle and Portland are simply about xx% higher up previous peaks.

The US median existing home price is nearly 40% college than its previous pinnacle in 2007. We're talking near a median existing home price from $250,000 in 2007 to $400,000 today. That's significant. But then again, 14 years take passed. As a real estate investor, your goal is to invest in markets that have both underperformed and have the potential to grab up.

5) Tax reform takes fourth dimension to negatively bear on housing prices.

Conceptually, we all know that limiting country income and property tax deductions to $x,000 and limiting mortgage interest deductions on new mortgages up to $750,000 are net negatives for expensive coastal city real estate markets. However, information technology takes i-2 years to get-go feeling the crunch of tax reform.

Recall about information technology. Let's say you own an boilerplate 3 bedroom, 3 bathroom home for $1.5 million. Your property taxes solitary price $17,000 – $20,000 a year, depending on which state you reside.

Let'due south say y'all earn $120,000 a twelvemonth. You'll have paid $6,000+ in state income taxes. In the past, yous could have deducted the entire $23,000 – $26,000 from your income. Now, you are limited to $x,000 in deductions.

Some will contend that lower income taxes will starting time these deduction limitations. Mayhap.

With Joe Biden as President, a whole host of new taxes could be increased or introduced. Given the regime is in such a massive deficit, higher taxes or cuts to resources are an inevitability. Revenue enhancement reform is a headwind, not a tailwind for coastal city holding price appreciation.

half dozen) Inventory is slowly creeping higher

The construction blast we've experienced over the past several years is finally showing up in the data as a moving ridge of new inventory hits the market. When at that place's more inventory, pricing comes under force per unit area if need doesn't follow. Beneath is the latest housing inventory under construction and authorized, simply not started.

Hither is a some other inventory of single family unit homes chart that showed what happened in one case the pandemic began. However, every bit of 2Q2022, inventory seems to have bottomed out and is likely going to go back up again.

Here's another latest housing inventory chart by Altos Research. Housing inventory is still way below normal. However, it'due south skilful to go along an eye on inventory given prices are also much higher.

For some of the hottest cities for real estate, like Austin and Nashville, inventory is definitely creeping higher. If inventory gets also high, these heartland cities are at risk of a housing downturn. Take a look at this chart beneath that shows single-family permits way up for Austin, Dallas, and Nashville.

Personally, I wouldn't be investing in cities in the height-right quadrant. Instead, I would be investing in cities in the green, lower-right quadrant. You don't really want to invest in markets where abode prices rose the most while likewise facing the well-nigh amount of increasing supply.

7) Information technology takes a while to recognize a peak.

The housing boom that began in January 1996 ended in March 2006. But it wasn't until the beginning of 2008 that people started to take that the housing market place had already peaked.

Until 2008, property investors were still clinging to hope or at least were in deprival that prices would no longer be going upward. One time Bear Sterns was sold for goose egg to JP Morgan in March 2008, people started to panic.

So Lehman Brothers went under on September 15, 2008, a full ii and a half years after the housing market peaked. And things got even worse, with the S&P 500 finally bottoming out on March 9, 2009. At least equally of 3Q2020, we already experienced an aggressive 32% refuse in the South&P 500 in March 2020.

Below is a great nautical chart that shows how badly housing prices corrected in some of our major cities. Detect how the previous boom lasted 10 years and the crash lasted 5 years. Therefore, 20221 could be the peak in the current housing smash and we don't even know it for several more years.

eight) The stock market has crashed multiple times

We saw a fierce 20% sell down in the S&P 500 in 4Q2018. And so we saw a 32% decline from peak-to-trough in the S&P 500 past March 23, 2020. The Due south&P 500 and the NASDAQ corrected by thirteen% and twenty%, respectively in 2022 already. Equally a upshot, investors need to watch out.

From policy errors by the Fed, to trade wars, to slowing global growth, to a potential war with Islamic republic of iran, to COVID-19, to a global pandemic, companies everywhere will be more cautious on their spending in 2022 and beyond.

Just know that prices tend to revert back to the mean or overshoot on the downside very 4 – x years. Existent estate takes 2-5 years to correct, and then there is no rush to buy at present.

I'thousand predicting very mediocre Due south&P 500 returns for 2022. We could easily close the year down. Then far, the South&P 500 is struggling in 2022 and the NASDAQ entered bear market territory.

Recognizing Signs Of Housing Market Strength

Although it'due south good to worry about the housing market again, let the states also recognize that the housing market has continued to rebound. Hither are some reasons for the housing marketplace's continued strength in America.

- Low mortgage rates and negative real mortgage rates.

- The S&P 500 closed upwards 18% in 2022 and up 27% in 2021.

- A rotation out of volatile stocks into more stable existent estate

- Nevertheless not plenty inventory

- The increased desire for income / yield

- Demand from institutional real estate investors competing confronting retail investors.

- Strange buyers will likely come back to the Usa in 2022+ with over $200 billion in pent-upwardly need

- Massive habitation equity accumulation since 2022 lonely, which will buffer downside risk

Buy Existent Estate Responsibly

The mass media and the real estate industry volition focus on strong demand, strong job growth, and a dearth of inventory as drivers for higher property prices in 2022 and beyond.

That'south fine if you can surgically buy in strong job cities via existent estate crowdfunding. The heartland of America is an specially attractive area to buy. Valuations are much cheaper and net rental yields are much higher. There should exist a multi-decade trend of spreading out across America thanks to engineering science.

However, there are more deals to be had in expensive coastal cities similar New York and San Francisco as well. Big cities are making a stiff comeback and have lagged the overall U.Due south. real estate market during the pandemic.

If you're dying to buy a primary residence today, make sure you can withstand a 10-twenty% correction over a v year time frame. Information technology'due south always proficient to plan conservatively. I don't think the housing market will crash in the next 3 years. In fact, I think nosotros'll average high single digit gains through 2024.

If y'all don't have a fiscal buffer equal to at least 10% of the value of your property afterward putting down 20%+, then you lot are not financially prepared for a downturn. You demand to endeavour and purchase at a price that is at least 5% lower than the previous comparable sale price.

Too much debt is actually what will kill y'all if we ever return to hard times. Buy a business firm to relish life instead of looking to make a profit. As shortly as you get-go hearing regular reports about people putting no money down, then it will be actually time to worry near the housing market place. But for at present, real manor is likely going to continue to outperform equities.

Build Wealth Strategically Through Existent Manor

Real manor is my favorite manner to achieving financial freedom because it is a tangible asset that is less volatile, provides utility, and generates income. Stocks are fine, but stock yields are low and stocks are much more volatile. The -32% decline in March 2022 was the latest example. Withal, real estate held steady and appreciated in value then.

Investing in existent manor crowdfunding is a solution for multifariousness and exposure. Instead of taking on a mortgage to buy existent estate, y'all tin can simply invest in a diversified private eREIT through a business firm like Fundrise. If you don't accept the downwardly payment or want to deal with tenants, investing through Fundrise is a hassle-gratuitous way to make passive income.

If you are a real manor enthusiast who likes to invest in individual deals, cheque out CrowdStreet. CrowdStreet focuses specifically on real estate opportunities in 18-hour cities where valuations are lower and rental yields are higher. The spreading out of America is a long-term trend thanks to technology.

I've personally invested $810,000 in real estate crowdfunding across 18 projects to take advantage of lower valuations in the heartland of America.

My real manor investments account for roughly 50% of my electric current passive income of ~$310,000. To be able to earn income 100% passively equally I take intendance of my two young children is a dream come up true.

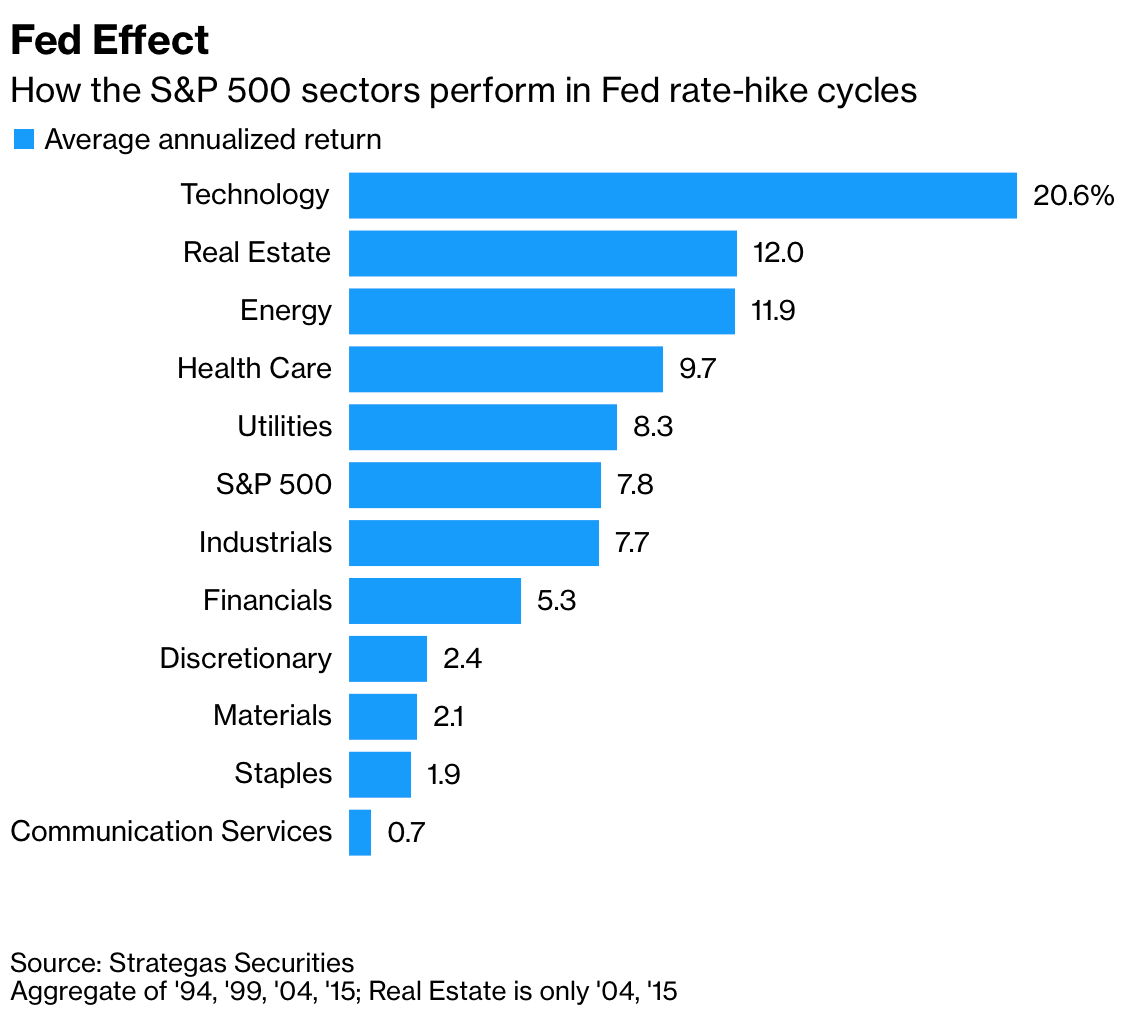

Below is a great chart regarding how real estate performs after previous Fed charge per unit-hike cycles. Maybe surprisingly, existent estate performs very well considering rising rents more than than outset college mortgage rates.

Refinance Your Mortgage

Check out Credible, my favorite mortgage marketplace where prequalified lenders compete for your business concern. You tin can get competitive, real quotes in nether three minutes for complimentary.

Mortgage rates are however most best lows, but they might start ticking upwards due to inflation. Accept advantage and lock in a generationally low mortgage charge per unit today. I was able to get a 7/1 ARM for ii.125% with nothing fees for a new forever home I bought in 2020.

Buy The Best Selling Personal Finance Volume

If you desire to drastically improve your chances of achieving financial freedom, purchase a hard copy of my new book, Buy This, Not That: How To Spend Your Way To Wealth And Freedom. The book is jam packed with unique strategies to help you build your fortune while living your best life.

Buy This, Not That is already a #1 new release and #ane best seller on Amazon. By the fourth dimension you finish BTNT you will gain at least 100X more value than its cost. After spending 30 years working in finance, writing about finance, and studying finance, I'grand sure you lot will dear Buy This, Non That. Cheers for your support!

It's Time To Start Worrying About The Housing Market Again is a FS original mail service. I've been a existent estate investor since 2003 and ain multiple properties today. Stay warning and bargain hard!

Source: https://www.financialsamurai.com/time-to-start-worrying-about-the-housing-market-again/

0 Response to "Make All These Hater Fall Back Like September Again"

Post a Comment